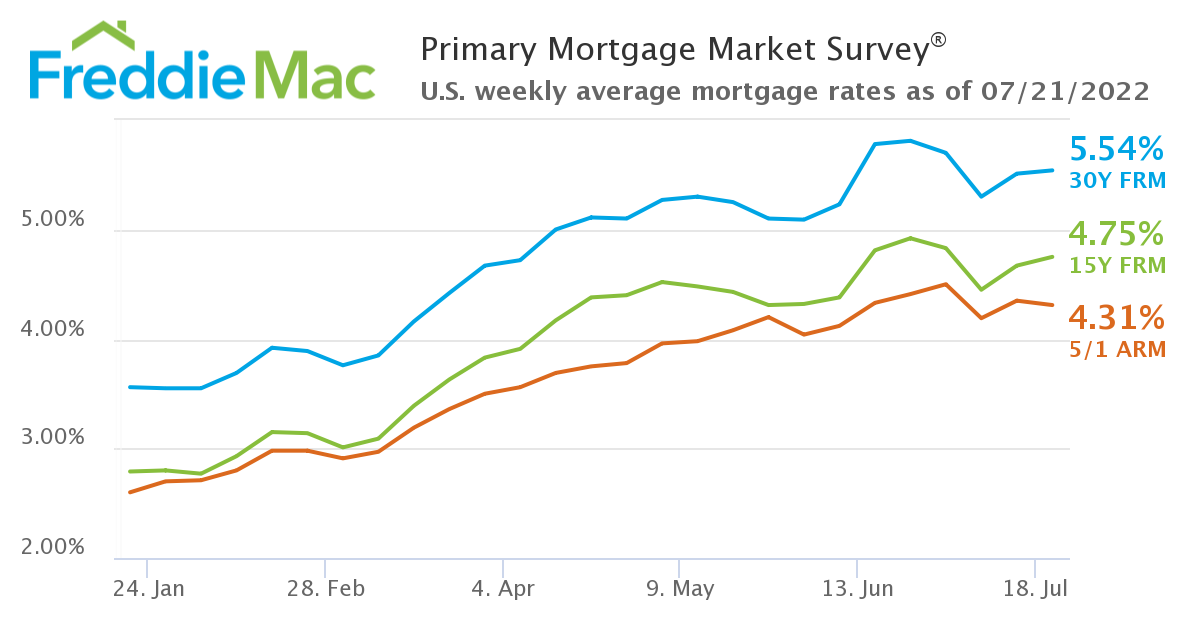

25+ adjustment rate mortgage

You can pay off the principal amount faster than with a 30-year loan. Skip The Bank Save.

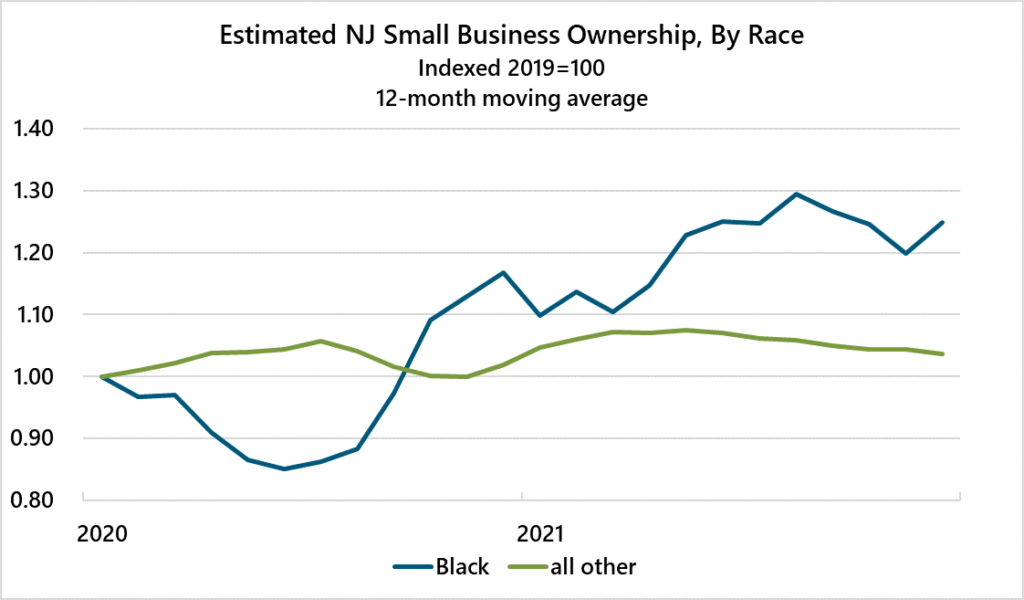

Economists Corner Archives Njeda

Find all FHA loan requirements here.

. Web Adjustable-rate mortgages typically have lower initial rates than you can get on a comparable fixed-rate mortgage. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Bank Home Loan Officer To Support You Throughout The ARM Loan Process.

Web An adjustable-rate mortgage ARM is a type of home loan that offers a low fixed rate for the first few years after which your interest rate and payment can move up. Web An ARM is a mortgage with an interest rate that changes or adjusts throughout the loan. Apply See If Youre Eligible for a Home Loan Backed by the US.

Web With a fixed-rate mortgage the interest rate and your monthly principal and interest payment stay the same throughout the life of your loan. Lower interest rates make this an attractive option. Web Adjustable-rate mortgages ARMs also known as variable-rate mortgages have an interest rate that may change periodically depending on changes in a.

ARMs may start with lower monthly payments than fi xed-rate mortgages but keep in mind the. This can help you build up. Thats because lenders have to charge more on fixed.

Hybrid ARMs have a fixed-term interest rate for a period followed by interest adjustments at set. Web An adjustable-rate mortgage ARM is a loan with an interest rate that changes. All loan options assume a 6 lifetime cap on.

Web If your interest rate is at 55 a 1 subsequent cap will not allow your rate to go beyond 65 for that period. Ad Todays 10 Best ARM Mortgage Rates. Web 2 hours agoOlder mortgage applicants were more likely to be turned down for a loan than their younger counterparts and theyre more likely to pay more for the loan.

Web Any or all of these adjustments will affect your mortgage rate and move it accordingly or change the costs of obtaining the loan. The third number shows you the. Web There are three main types of adjustable-rate mortgages.

Web This 525 adjustable rate mortgage calculator displays worst case scenario as principal pay-down is not calculated. Ad Are you eligible for low down payment. Web 15-year fixed-rate mortgages.

With an ARM the interest rate and monthly payment may start out low. Web Model H-4D1 illustrates the interest rate adjustment notice required under 102620c and Model H-4D2 provides an example of a notice of interest rate adjustment with. Use Our Comparison Site Find Out Which Lender Suits You The Best.

Web Adjustable-Rate Mortgage Calculator Calculate your adjustable mortgage payment Adjustable-rate mortgages can provide attractive interest rates but your payment is not. Ad Top Home Loans. Ad Weve Researched Lenders To Help You Find The Best One For You.

Ad Connect With A Loan Officer Today. Say your total adjustments add up to 1125. Start Our ARM Online Application.

Apply Easily Get Pre Approved In a Minute.

:max_bytes(150000):strip_icc()/what-is-an-adjustable-rate-mortgage-3305811_V2-d24ce035796b4b3ebb7cee3f65049a24.png)

Adjustable Rate Mortgage Definition Types Pros Cons

25 Best Mortgage Brokers Near Mead Colorado Facebook Last Updated Mar 2023

Adjustable Rate Mortgages Are Back But Are They Worth The Risk

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

25 Housing Market Predictions For The Next 5 Years 2023 2027

Home Mortgage Refinancing Tips For A Smarter You

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Catc Ex991 24 Pptx Htm

Ifc Bulletin No 26 July 2007 Bank For International Settlements

Adjustable Rate Mortgages Basic And Optional Features

What Is The Difference Between A Home Equity Loan And A Cash Out Refinance Quora

Federal Funds Rate Definition It S Impact The Motley Fool

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

With Mortgage Rates So Low Is Now A Good Time To Refinance

A Mortgage Lender S Guide To The Types Of Home Loans

What Is An Adjustable Rate Mortgage Bankrate

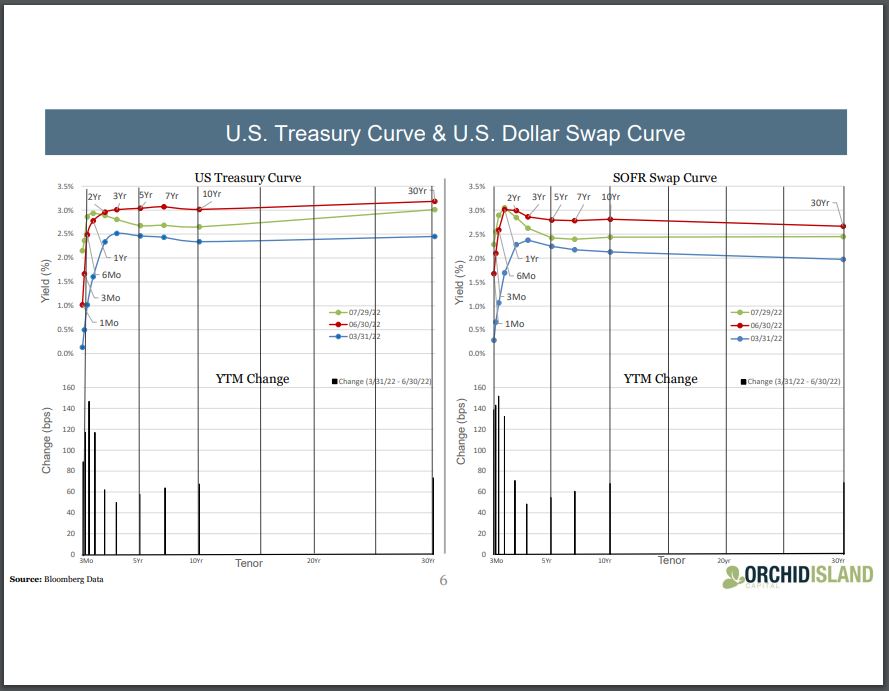

Monthly Dividend Stock In Focus Orchid Island Capital